Is hydro power the only profitable electricity production in Norway?

Denne artikkelen er over ti år gammel og kan inneholde utdatert informasjon.

By Tyson Weaver

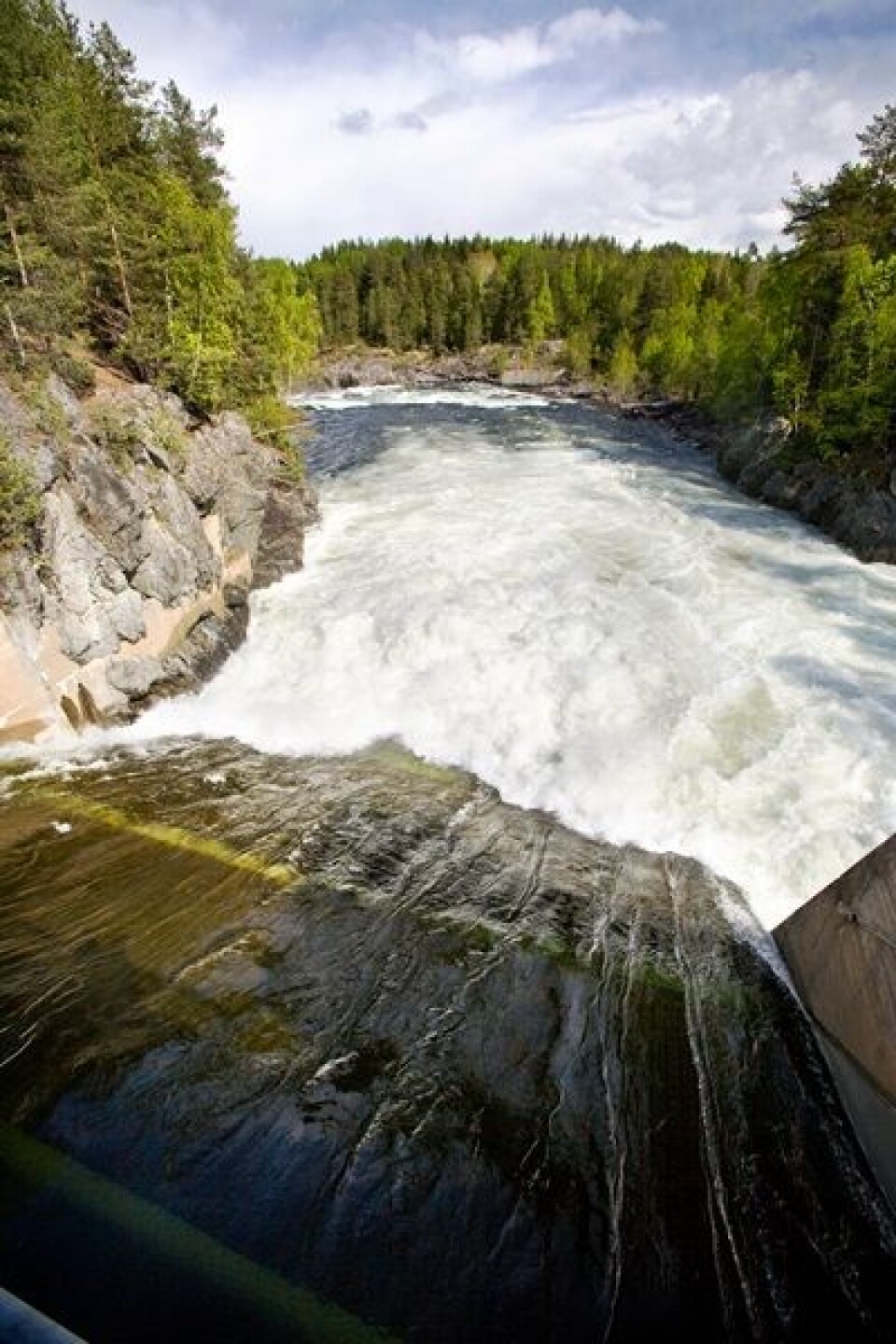

As Jens Stoltenberg’s famous words rang out “the days of large Norwegian hydropower are over,” a decade on many electricity production firms have sought out other avenues to pursue company level growth.

We have seen a number of traditional power production enterprises investing in new ventures. Most ventures all follow similar paths of power production, albeit in altered forms. Whether the new production is coming from water, wind, sun or wood, the path remains renewable for electricity production here in Norway.

Newer methods of energy production have allowed such investments to be justified, but how have they fared, economically speaking? As we know all power production has to compete in Nordpool on a bid and offer equal basis. Prior to the Swedish green certificate market introduction here in 2012, investment support granted alleviated capital exposure at the onset, but long-term production costs remain exposed when competing against long standing capitalized investments (large hydro power).

So the simple question remains- are other forms of renewable energy production profitable through the eyes of the beholder here in Norway?

Whilst little literature exists that directly answers such a question, the outcome shall change shortly upon the introduction of production tied subsidies, and how the influx of new production alters the behavior of wholesale market prices. Market signals suggest that offshore wind power production is off the table, onshore wind power has good potential (but is painfully slow to realize plans), and bioenergy uptake mediocre. That all forms of renewable power production have their pros and cons, but which can produce the scale of relative returns traditional large-scale hydropower producers are accustomed to? Where does this leave the well capitalized traditional power producers to invest idle funds in seeking out company level growth strategies?

It appears one diversification option has been a recent trend towards investigating opportunities abroad. Whilst the days of large Norwegian hydropower production may be over, the days of large hydropower abroad are far from over.

Research questions surrounding this shift in corporate strategy are based around path dependency, trust in cross national business relations, and complex risk assessment-mitigation for undertaking such activities. Will the future of traditional hydropower producers continue to be solely within domestic production and operations, or will we see a shift of diversified operations onto the global stage?

Equally as important as a question to ask: will the underlying beneficiaries of these local energy companies, kommunene, allow their funds to be put at risk when committed abroad in foreign direct investment?